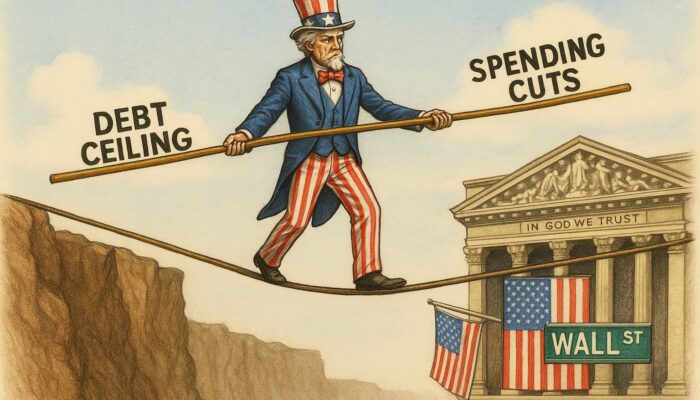

Will The Senate Crash The Stock Market?

Posted June 3, 2025

A new Macro Watch video has just been uploaded.

The stock market boom of recent years has been powered by surging Household Wealth and skyrocketing Government Debt. But now, both of those growth engines are at risk.

This video explains why the economy and financial markets have become more dependent than ever on continued government borrowing and spending—and why any disruption to that support could send stock prices crashing.

Here’s what this presentation reveals:

- Credit growth has been exceptionally weak for the past three years—well below the historical threshold that typically signals recession.

- And yet, the economy has continued to expand. Why? Because a $52 trillion explosion in Household Wealth since 2019 has replaced Credit as the main driver of growth.

- But that new growth model has a serious flaw: it is highly vulnerable to asset price declines—and asset prices are now far above historical norms relative to income.

- At the same time, Government Debt has become the dominant force behind both credit creation and wealth creation. Last year, it accounted for more than half of all new debt in the US economy.

- That makes the current Senate budget negotiations a critical turning point. If the Senate imposes deep spending cuts—as many fiscal hawks are demanding—asset prices could fall sharply, dragging the economy into recession.

And there’s another threat…

- The House-passed budget bill includes a $4 trillion debt ceiling increase—but some Senators are threatening to block it unless major spending cuts are included.

- If the debt ceiling isn’t raised soon, the Treasury could run out of cash by August, potentially triggering a technical default.

- A debt ceiling crisis during a period of overstretched asset valuations and weak credit growth could set off a financial crisis—fast.

With both the budget deficit and the debt ceiling on the line, the risk of a policy mistake is high—and the consequences could be enormous.

Watch this video to understand why the stock market’s fate may now rest in the hands of the U.S. Senate.

Macro Watch subscribers can log in and watch this video now.

If you have not yet subscribed, click below for immediate access to this video and all other Macro Watch videos.

Subscribe now and use the discount coupon code “Senate” for a 50% subscription discount.

You’ll find more than 100 hours of video content available to help you understand what’s happening in the global economy—and what’s likely to happen next.

👉 Click Here To Subscribe To Macro Watch

Interested in economics? Click HERE for a list of some of the most influential and interesting books on Economics ever written.