Liquidity Tsunami May Drive Asset Prices Much Higher

Posted March 6, 2021

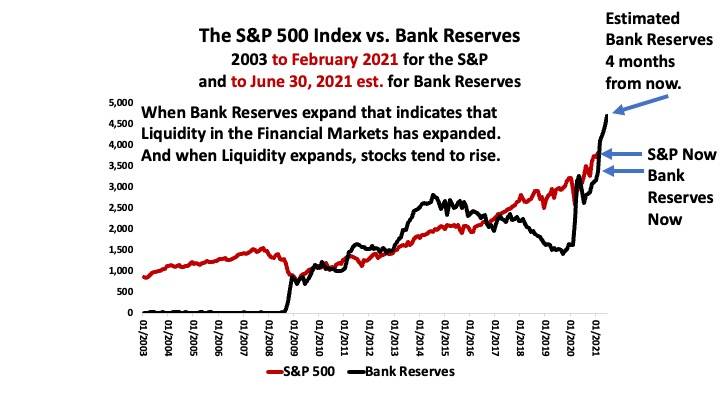

A Tidal Wave of Liquidity may soon be injected into the Financial System. If it is, asset prices could rocket higher.

The Treasury Department estimates that it will run down the funds in its bank account at the Fed from $1.44 trillion on February 24th to $500 billion on June 30th. If it does, that will inject $940 billion of liquidity into the markets.

If the Fed continues to create $120 billion a month through its asset purchase program, as it has repeatedly stated that it will, that will add a further $480 billion of Liquidity.

Combined, these two developments would boost Bank Reserves by $1.4 trillion over the next four months.

Even after making adjustments to incorporate the reduction to Bank Reserves that will occur as Currency in Circulation expands, Bank Reserves would still surge by $1.3 trillion by mid-year. That would represent a 39% jump over the next 12 weeks.

The injection of so much additional Liquidity into the Financial Markets over such a short space of time, if, in fact, it does occur, has the potential to cause the speculative frenzy in the Financial Markets to intensify and drive asset prices much higher.

The latest Macro Watch video explains all the factors involved, including a number of developments that could prevent such a scenario from playing out.

Macro Watch subscribers can login and watch this video now. It is 13-minutes long and contains 25 slides that can be downloaded.

If you have not yet subscribed to Macro Watch and would like to, click on the following link:

For a 50% subscription discount hit the “Sign Up Now” tab and, when prompted, use the coupon code: Frenzy

You will find more than 50 hours of Macro Watch videos available to watch immediately. A new video will be added approximately every two weeks.

Finally, for a list of other Macro Watch videos you may have missed, click HERE.

Please share this blog with your colleagues and friends.

No comments have been made yet.