Will The Liquidity Tsunami Continue To Drive Asset Prices Higher?

Posted April 29, 2021

A Liquidity Tsunami is currently driving asset prices to new record highs.

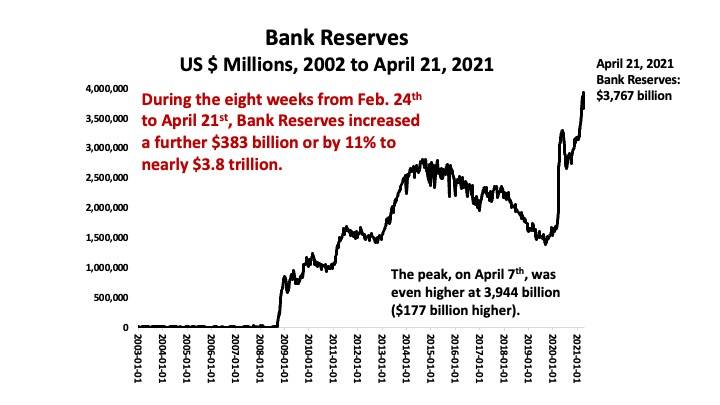

In early March, Macro Watch published a video called “Liquidity Tsunami May Push Asset Prices Much Higher”. Since then, Liquidity, as reflected in Bank Reserves, has surged by 11% and stock prices and home prices have risen to new record highs.

The latest Macro Watch video shows that Liquidity looks set to expand by a further 34% by the end of the year. Should that occur, and barring unexpected shocks, asset prices could continue to be driven significantly higher during the months ahead – at least up until the time the Fed signals that it is considering tapering the current round of Quantitative Easing.

Liquidity has become the most important factor determining whether asset prices move up or down.

This video looks at the factors behind the surge in Liquidity and asset prices over the past eight weeks and explains why they are likely to continue supplying abundant Liquidity during the next eight months.

It also explains what Bank Reserves are and discusses the factors that cause them to expand and contract. It does this by explaining the Fed’s weekly H.4.1 Report, where all the factors Supplying and Absorbing Bank Reserves are published. Anyone who wants to understand Monetary Policy must learn how to read and interpret this report.

This video is 29-minutes long and offers 41 slides that can be downloaded.

Macro Watch subscribers can log in and watch it now.

If you have not yet subscribed to Macro Watch and would like to, click on the following link:

For a 50% subscription discount hit the “Sign Up Now” tab and, when prompted, use the coupon code: Update

You will find nearly 75 hours of Macro Watch videos available to watch immediately. A new video will be added approximately every two weeks.

Finally, for a list of other Macro Watch videos you may have missed, click HERE.

Please share this blog with your colleagues and friends.

No comments have been made yet.