Very Bad Things May Happen Due To The Fed’s Hawkish Pivot

Posted December 6, 2021

In Congressional testimony last week, Fed Chairman Powell made a “Hawkish Pivot” when he suggested that the Fed was likely to accelerate the pace of Tapering and end Quantitative Easing a few months sooner than previously indicated.

If the Fed really does Taper QE more rapidly, it could provoke a sharp correction across most asset classes, for a number of reasons:

- A quicker end to QE will mean less new Liquidity than the markets had expected.

- It also means the Fed could hike interest rates as soon as the second quarter of next year, and that there could be more rate hikes in 2022 than anticipated.

- And, if the markets begins to expect rate hikes, the Dollar could strengthen substantially more, with negative consequences for gold, other commodities, world trade, economic growth and corporate profits.

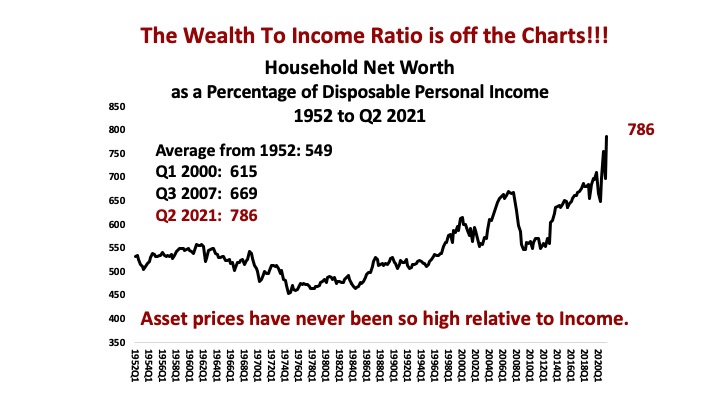

Asset Prices have never been more inflated relative to income, speculation is rampant, and leverage is very high.

In this environment, if the Fed becomes more aggressive in tightening Monetary Policy, very bad things could happen in the financial markets, especially to highly leveraged investors.

The latest Macro Watch videos spells out all the risks associated with the Fed’s “Hawkish Pivot”.

Macro Watch subscribers can log in now for all the details on what could go wrong.

The video is 14 minutes long and offers 33 slides that can be downloaded.

If you have not yet subscribed and would like to, click on the following link:

For a 50% subscription discount hit the “Sign Up Now” tab and, when prompted, use the coupon code: Bad

You will find more than 75 hours of Macro Watch videos available to watch immediately. A new video will be added approximately every two weeks.

Finally, for a list of some great books about or by Paul Volcker, Robert Rubin, Hank Paulson, Timothy Geithner, Alan Greenspan and Ben Bernanke click on POLICYMAKERS HERE.

Please share this blog with your colleagues and friends.

No comments have been made yet.