What The US Must Learn From Japan

Posted November 27, 2020

The new Macro Watch video compares the Japanese economic policy response to Covid-19 with that of the United States – in terms of its impact on government debt, central bank balance sheets, the Money Supply, interest rates and inflation.

The video shows that:

- Japan’s fiscal and monetary policy response to the pandemic has been considerably less forceful than that of the US; that

- Japan’s Government Debt and Central Bank Assets relative to GDP are still very much higher than those of the United States; and that

- Despite decades of surging Government Debt and Quantitative Easing, Deflation remains a greater threat to Japan’s economy than Inflation.

Modern Monetary Theorists argue that, in the post-Bretton Woods world, an economically advanced country with its own central bank does not face “financial constraints” only “resource constraints”.

By this they mean that there are no Financial Constraints on how large a country’s government budget deficit or debt can become because the government is always free to create money and spend.

Instead, Resource Constraints impose the limits, because, if excessive government spending absorbs all the resources available to a country, then inflation will accelerate and high rates of inflation will force a change in the government’s spending or tax policies.

Japan seems to dramatically prove their point concerning the lack of Financial Constraints.

Japanese Government Debt is measured in the Quadrillions. It is currently Yen 1.2 Quadrillion.

The IMF projects the ratio of Japanese General Government Debt to GDP will increase from 238% in 2019 to 266% in 2020, an increase from 64% thirty years ago.

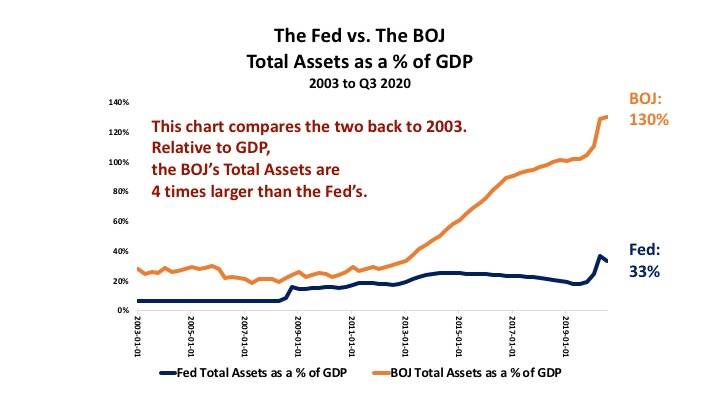

The ratio of the Bank Of Japan’s Total Assets to GDP is 130%, compared with 25% ten years ago. 130% is four times the ratio of the Fed’s Total Assets to GDP.

And despite all this, Japan’s inflation rate and the yield on Japanese Government Bonds are both currently 0%.

This clearly demonstrates that since Japan’s economic bubble popped in 1990, Japan has faced neither Financial Constraints or Resource Constraints.

For 30 years, the Japanese Government has borrowed and spent aggressively, primarily on infrastructure; with the BOJ financing the government’s borrowing at low interest rates by creating money and buying Japanese Government Bonds.

That approach has prevented a Japanese Great Depression, but it has not succeeded in generating high rates of economic growth.

As the United States considers its policy options for 2021 and for the years beyond, it must look to Japan to understand what is possible; and to understand which policies work and which do not.

The video concludes by discussing the three important lessons the United States must learn from Japan’s experience if it is to maximize economic growth, prosperity and national security.

Macro Watch Subscribers can log in now and watch What The US Must Learn From Japan for all the details. The video is 18 minutes long with 40 slides that can be downloaded.

If you have not yet subscribed to Macro Watch and would like to, click on the following link:

For a 50% subscription discount hit the “Sign Up Now” tab and, when prompted, use the coupon code: Yen

You will find more than 50 hours of Macro Watch videos available to watch immediately. A new video will be added approximately every two weeks.

Please share this blog with your colleagues and friends.

No comments have been made yet.