Surging Money Supply Growth Won’t Cause Inflation

Posted March 26, 2021

Will asset prices soon be crushed by Inflation and higher Interest Rates? This is perhaps the most important question investors must grapple with today.

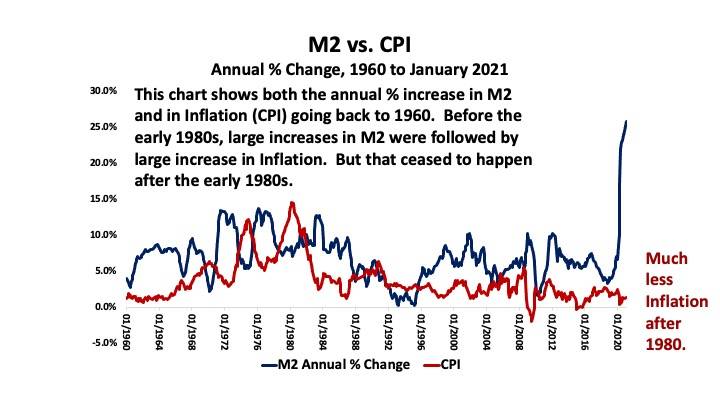

The financial markets are on edge because many economists and financial analysts are warning that the recent large increase in the Money Supply will lead to high rates of Inflation.

They believe that because, in the past, large increases in the Money Supply did lead to high rates of Inflation.

If these warnings are correct and Inflation does move significantly higher, then Interest Rates will move much higher too.

If that were to occur, the price of stocks, property and even Gold would plunge.

These fears are misplaced, however. Large increases in the Money Supply no longer cause high rates of Inflation. This is true for large increases in Base Money. It is also true for large increases in M2. Neither push the Inflation Rate higher now.

There are two reasons for this:

- Money is no longer what it used to be.

- Our economy is no longer what it used to be.

The new Macro Watch video is a mini course on Money and the relationship between Money Supply Growth and Inflation, both in the past and today.

It begins by explaining why large increases in the Money Supply used to cause high rates of inflation. It then goes on to discuss the three major developments that, over time, severed the link between Money Supply growth and the Inflation Rate.

Topics include:

- The composition of the Money Supply when Dollars were backed by Gold versus the composition of the Money Supply now that Dollars are no longer backed by Gold.

- How the Fed creates Money and Credit today.

- How Banks create Money and Credit today, compared with how they created Money and Credit in the past.

- What are Bank Reserves and how they are created.

- The Money Multiplier in a system of Fractional Reserve Banking.

- The significance of the Required Reserve Ratio.

- The Velocity Of Money: why it mattered in the past but is entirely meaningless in the 21stCentury.

- The real reason Inflation collapsed beginning in the early 1980s.

- Why the Credit Supply, rather than the Money Supply, matters now.

- And why the Credit Supply, which leapt in 2020, is unlikely to continue to grow enough this year and next to push Inflation meaningfully higher on a sustained basis.

This video provides Macro Watch subscribers with a framework that will help them determine whether Inflation will crush asset prices during the months ahead as Monetary and Fiscal Policy evolve.

It is 35-minutes long and offers 71 charts and slides that can be downloaded. Macro Watch subscribers can log in and watch it now.

If you have not yet subscribed to Macro Watch and would like to, click on the following link:

For a 50% subscription discount hit the “Sign Up Now” tab and, when prompted, use the coupon code: Supply

You will find more than 50 hours of Macro Watch videos available to watch immediately. A new video will be added approximately every two weeks.

Finally, click HERE to see the list of the videos in the Macro Watch Course on Monetary Policy, which subscribers can watch at any time.

Please share this blog with your colleagues and friends.

Richard, in your opinion, is the FED a major cause of inequality? It seems like capital has benefited the most from FED intervention while labor gets left behind. The financial markets and real estate have grown faster than GDP while labors’ share of GDP has shrank over time.

Dino, Yes, I do believe the Fed’s policies have worsened inequality. However, I also believe that they had no choice. If they had not stopped the economy from collapsing in 2008 and again in 2020, millions of Americans would have had a bigger problem than being “left behind”. They would have been hungry. The human costs of that would have been terrible. The political repercussions could have been catastrophic. Just think about what happened during the 1930s and 1940s. So, I believe they made the right choice.