Credit Update: Government Debt Spikes

Our economic system evolved from Capitalism into Creditism once money ceased to be backed by gold 50 years ago. Under Capitalism, economic growth was driven by Saving and Investment. Under

All The Money In The World

Earlier Macro Watch videos this year have shown how the central banks of the United States, Japan, Europe and China have created money on a multi-trillion dollar scale and deployed

Excellent Podcast Explaining The US-China Tra…

In this Financial Sense podcast, Cris Sheridan and I discuss all aspects of the US-China Trade War, including why it could be a turning point in history, one that not

Chinese Monetary Policy Part 2: Crisis Manage…

Large-scale capital flight out of China threatened to send the Chinese economy into crisis beginning in mid-2014. As a result, the People’s Bank Of China was forced to radically change

Renegade Inc. TV Interview. Highly Recommend…

In this television interview for Renegade Inc., Ross Ashcroft and I discuss Creditism and the opportunities and dangers that exist at this unique moment in history. The global economy no

Chinese Monetary Policy, Part 1: Transforming…

Between 1990 and 2014, the People’s Bank Of China created RMB 28 trillion, the equivalent of more than US$4 trillion. What the central bank did with that money turned China

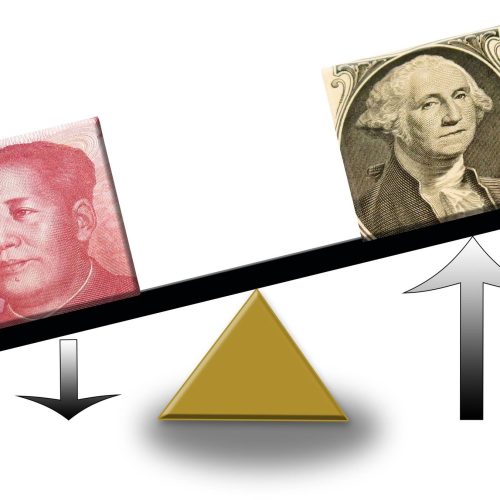

Trade War Part 3: If China Fights Back

It is inconceivable that China would submit to President Trump’s demands that China reduce its trade surplus with the US by $200 billion per year. If the United States imposes

Trade War Part 2: If China Capitulates

President Trump has threatened to impose trade tariffs on all $500 billion worth of goods that China exports to the US each year unless China submits to his demands to

US-China Trade War: On The Brink

President Trump believes China poses a grave threat to the United States. His demands for trade concessions from China are designed to eliminate that threat. China cannot possibly meet those

US-China Trade War Could Be A Turning Point I…

Last night I watched “Death By China” on YouTube. If you haven’t, you should. It’s free. This documentary was made by Peter Navarro, the Director of the United States National