The Fed May Lose $50 Billion in 2023

Last year, if the Fed had been a corporation, it would have been the most profitable corporation in the world. It earned $108 billion. Apple earned $100 billion. Apple paid $19

TIP Interview: “One Of My Favorites Thi…

“This is one of my favorite interviews of the year so far. Richard @PaperMoneyEcon brings the 🔥 fire,” tweeted Trey Lockerbie, regarding our recent conversation for The Investor’s Podcast. Given all the

China Downgraded

“China’s economy will not overtake the US until 2060, if ever” That was the title of an article written by Ruchir Sharma, the chair of Rockefeller International, and published in

New Interview. Highly Recommended. Top Trader…

Today I would like to share with you a very interesting discussion I had recently with Kevin Coldiron and Niels Kaastrup-Larsen for the Top Traders Unplugged podcast. I strongly recommend

Creditism In Crisis?

Another set of very bad Inflation numbers was released on Thursday. The headline CPI index was up 8.2% from one year ago, little changed from the month before. Worse still, the Core

Watch Out: Something Is Going To Break!

Last week, the Fed shocked investors when it released new projections showing that it now expects to increase interest rates significantly more than it had planned to do just three

2008 vs. 2020 Part Three: Monetary Stimulus

The US Monetary Base surged nearly twice as much following the Crisis of 2008 as it did following the economic crisis caused by the Covid pandemic in 2020. Yet Inflation has

2008 vs. 2020 Part Two: Fiscal Policy

The new Macro Watch video, the second in a series, compares the Fiscal Policy Response to the Crisis of 2008 with the Fiscal Policy Response to the Crisis of 2020.

2008 vs. 2020: Crisis, Response, Recovery

The new Macro Watch video compares the US government’s policy response to the two great economic calamities of our time: the Crisis of 2008 and the economic crisis that began with Covid in

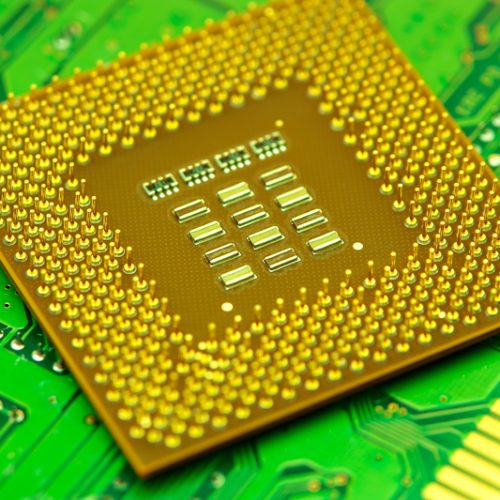

The Chips and Science Act

Today, The Chips and Science Act, authorizing a $280 billion government-funded investment in new industries and technologies, was signed into law by President Biden. The Act authorizes the largest five-year